We often hear two common responses from potential clients – either they already have a bookkeeper, accountant or finance manager in place that looks after billings, or they use QuickBooks for their billing system already. Our response to the bookkeeper system will be addressed in a future article, so for now we will focus on the matter of QuickBooks software (QB) and how it is an apple to TUIO’s orange, so to speak.

Why TUIO is Built for Schools

Although QuickBooks may be the perfect choice for bookkeeping in the business world, it’s not very well-equipped for schools. It has some serious shortcomings when dealing with the unique payment situations schools deal with every day, such as managing tuition, billing for extracurricular activities, and offering flexible payment plans.

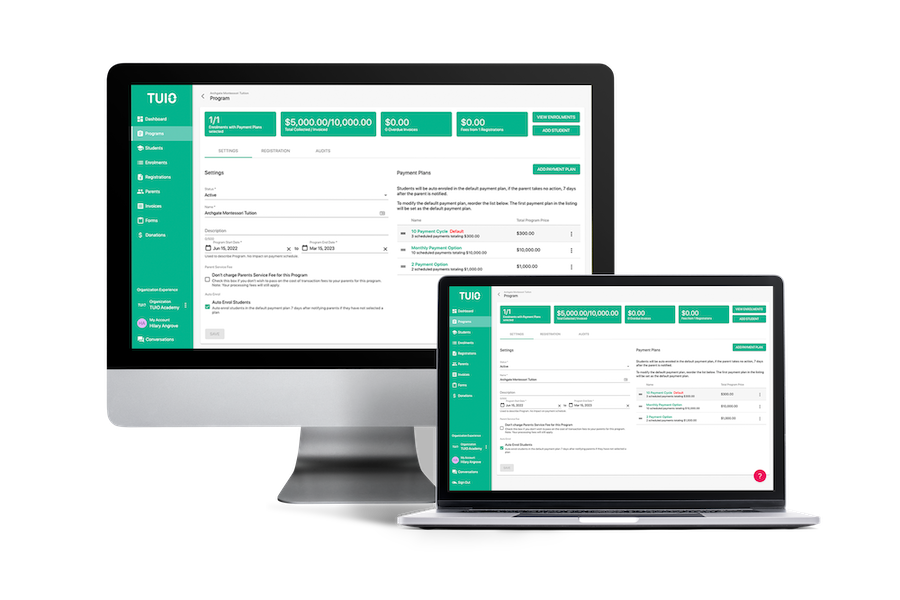

TUIO, on the other hand, offers a QuickBooks alternative that is purpose-built to meet the specific needs of schools. Every aspect of the platform, from the parent portal to its flexible payment plans to automated reminders, has been designed from the ground up with education in mind. Our accounting software’s ability to handle recurring payments, customized plans, and parent-controlled payment options help create the best possible experience for administrators as well as families. QuickBooks can’t match that, no matter how hard you try to hammer it into shape.

Addressing Common Concerns With QuickBooks

School administrators who rely on QuickBooks often find themselves struggling to fit the application into their operations. It can feel a lot like trying to cram a square peg into a round hole, when it works at all. For example, QB doesn’t allow users to create custom payment plans, manage split families, or handle scholarships in the most efficient manner. Factor in the fact that it also requires a lot of manual processes, and you have a recipe for frustration.

Where TUIO differs is its education-based design and virtually effortless automation. With our platform integrated into your offices, you can cut down on tedious and error-prone manual processes. You also won’t have to worry about staying on top of late payments or sending out reminders to families because TUIO handles all of that automatically, behind the scenes. This is critical for maintaining the level of trust and transparency that lead to successful relationships with families.

1. All of our clients use accounting software, and most of them are using QuickBooks.

Maybe you like apples, and there is no denying that QuickBooks is a useful tool that can be integral to the financial health of your business. This mainly factors into the accounting side with all the elements the software provides your school to keep track of the books, and create your financial statements and snapshots. Of the hundreds of schools we work with, nearly all use QuickBooks for accounting purposes because of its ease of use, widespread appeal, and reasonable cost. They also use TUIO because having a simplified billing system dedicated to a school’s needs that saves time is worth the investment.

While QuickBooks does offer tools related to accounts receivable and invoicing, the means of creating those invoices and collecting those invoices are clunky and cumbersome to you as a busy staffer at the school. Relying largely on manual creation, manual input, forms being filled out, and entering payment method data, the whole process is messy and time consuming. If you choose to send out invoices by email on QuickBooks, you have to wait for the families you have as clients to make their payment(s). Furthermore, issuing payment reminders on QuickBooks is a fully manual process that you have to individually set up and initiate to send to the people needing the extra push.

2. Why a parent portal, automated payments and automated reminders are necessary for your well being.

Setting up recurring payments on QuickBooks is a hassle, and parents can’t select how they would like to pay by themselves. In fact, if you use QB Payments outside of the US, you’re not even able to accept anything but credit card payments (sorry Canada..). Even if you are in the US and are able to offer bank account as a payment method, the fees for doing so are exorbitant. You also can’t easily pass on credit card service fees to parents as it is not possible for recurring payments on QB, sure you could add the item on as a line of the invoice, but again this is more manual work to set up and will often get overlooked. Do you really want to bear the brunt of credit card transaction fees? On QB you can’t set up a flexible, custom plan with different amounts every month (or other custom frequencies) for many months all recurring, let alone have them all come due and go to paid automatically. Finally, QB only offers deposit payouts in 2-3 business days, which doesn’t compete with the next-business-day payouts that we can offer.

Enter TUIO:

Parent Portal

With TUIO on your side, you have a full parent portal given to each family. They can log in and view past payment history in their invoices tab, set up payment in just a few clicks in the programs tab, choose from a multitude of payment plan options that they may prefer (monthly, upfront, quarterly, whatever you make available), and maybe even pick an early bird option at a discounted rate, if applicable. Parents can switch seamlessly from one payment method to another: maybe in September they wish to pay by Visa, October by Mastercard, November by Bank Account, December by Bank Loan. It’s easy for them to login to their account and set that up as desired. In addition, parents are allowed the input to approve or decline invoice changes made to their account after an invoice has been issued on TUIO. This helps to build trust and gives parents a voice for feedback, rather than having to charge them without consent on QB because you have their financial data. Ultimately, the increased transparency given to parents to see what payments are made and which are upcoming is a worthwhile advantage over QB, on top of the many other benefits of having TUIO.

Automated Payments

On TUIO, payments are automatically deducted from the parents’ chosen payment method on the invoice due dates. Our algorithmic solution helps to mitigate the need for late fees and overdue payments. When a parent sets up a bank account as payment method, they agree to a pre authorized debit agreement electronically in the set up window and a copy is sent out to their email for record keeping and legal compliance – this is in contrast to many other providers (incl. QB Payments) who leave this burden for you to take care of separately (not doing so makes you liable to all sorts of legal troubles including fines). Credit card fees can be passed on to parents, and are calculated automatically in the software, so no more spreadsheets and number crunching if you were looking to add the charge in on a QB invoice to a parent. When a parent chooses to pay by credit card, the fees are transparently shown on both the invoice and the amount due when clicking confirm to set up payment in a program. All this automation for billing, collecting, and reconciling your funds is going to save you hundreds of hours over a school year session. While you may not be involved in this space for money alone, the saying ‘time is money’ still applies when you are responsible for the wages of teachers and other staff and for providing quality education/care.

Automated Reminders

While as previously mentioned, the need for overdue payment reminders is reduced by using TUIO because of the way it is set up and automated, the peace of mind of knowing that an overdue payment will be tracked and a reminder to parents sent automatically is still a pleasant advantage. 24 hours after a payment goes overdue, TUIO automatically sends an overdue invoice reminder to parents. From there, you can send out invoice reminders either individually or in bulk to the parents easily in the invoices tab on TUIO, choosing whatever frequency you desire (7 days, 14 days, etc).

3. QuickBooks is not tailor made for school administrations.

One of our more tech-savvy clients, who we’ll call Bill, made the switch from using QB invoicing to using TUIO in 2019. Once he did, he found that attempting to duplicate the functionality of TUIO on the QB interface was nearly impossible. Even as an intelligent software developer, Bill found it very difficult to turn QB’s blank, flat structure of invoices into something resembling TUIO. For example, Bill tried to mimic things by creating “Classes,” but the workload was too high, and would have required high-level knowledge in QB.

TUIO is conceptualized in the framework of a school, we have “Programs” that are anything you need to bill for. Tuition, Aftercare, Music Lessons, Lunches, Field Trips, Camp, are all examples of things that could be a program, even a Parents night out!

“Students” get added to “Programs” and the invoices are generated according to the payment plan “Parents” select. You can also select a payment plan on behalf of the parent and in doing so customize the payment in the midst of the same program as everyone else! So there’s no need to create unnecessary programs or invoices just for special case students like split families, scholarships, tuition assistance.

These entities, Students, Parents, Programs, properly align with your business and allow you to reward your staff utilizing TUIO and your families with an online payment solution created with them in mind. Some other school-centric accounting features you won’t find anywhere easily on QB are automated tax receipts that can be created with just a click and sent to parents, a dashboard in your home page to keep track of past and future payments and how well you are doing financially, unlimited customer support for both your administrative team and your families to get help if needed, and a dedicated account manager to support the account you have with us.

4. How TUIO interfaces with QuickBooks

Hopefully you now see how TUIO is a strong contender to complement QB, even allowing you to lower your QB bill in terms of services you need to use, and the transaction fees incurred, since as mentioned all our clients use some form of accounting software, and the majority use QB.

QB is still a vital tool for accounting purposes, and TUIO data from the invoices tab of your account can be exported and entered into QB very easily to keep track of your revenue, thanks to TUIO’s integration capabilities. And while you will have no payment reconciliation to do with TUIO since it is automated, you will be given monthly deposit reports to keep track of what came into your bank account, broken down by parent name.

Saving Time and Money With TUIO

Switching from QuickBooks to TUIO can be a great way to improve the operational efficiency of your school’s offices. The powerful automation means your staff spends less time on manual data entry and management as well as tracking down families who are behind on their payments. With less time spent pouring over spreadsheets, your team can spend more time focusing on important tasks that have a bigger impact on the families you serve.

Additionally, key features such as credit card fee pass-through and secure payouts help lessen your administrative burdens and experience improved cash flow. It all adds up to significant reductions in hours spent dealing with your finances and lower operational costs every billing cycle. These are just a few of the many reasons why TUIO offers a stronger QuickBooks alternative for invoicing.

Next Steps

To conclude, having QuickBooks should not be an open-and-shut case when thinking about employing or demoing another school invoicing software, the work we have done to develop this best-in-class system is with your best interest in mind and taking into account the unique needs of a scholastic facility. Think of the ways we can help you save time and money, boost your enrollment, accelerate your cash flow cycle or get in touch with us if you need more information.

If you would like to see our product in action, book a demo with us today!